A money order is a payment order for a pre-specified amount of money. As it is required that the funds be prepaid for the amount shown on it, it is a more trusted method of payment than a cheque.

Steps to fill out a money order

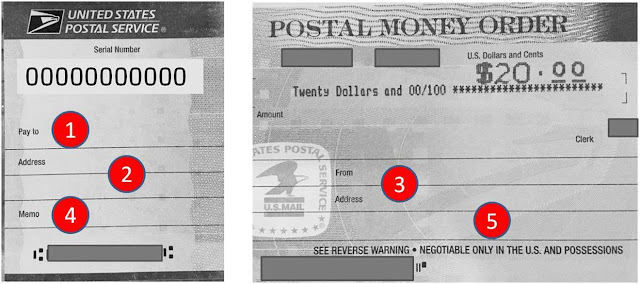

- Fill in the name of the recipient. Write the name of the recipient of the money order in the “pay to” or “pay to the order of” field. ...

- Include your address in the purchaser section. ...

- Write the account or order number in the memo field. ...

- Sign your name in the “purchaser's signature” section

You can use instead of checks, money, or a Credit Visa card. A money order can be bought through banks, cash moves suppliers like Western Union or MoneyGram, the U.S. Postal Service, supermarkets, and other retail stores. Filling out a money order isn’t complicated, but it does require entering the right information and doing so correctly. If you’re filling out a money order for the first time, it’s helpful to understand how to do it step by step.

What Information Is Needed for a Money Order?

The money order is basically a sort of prepaid check. What's more, similarly likewise with a check, there are sure things you need to incorporate for it to be substantial.

Money orders can appear to be unique, contingent upon where you get them. Notwithstanding where you buy a cash request, you'll ordinarily have to fill in the accompanying to finish it:

- Payee name

- Payee's location

- Date of procurement

- The dollar sum you're paying

- Your name and address

- Justification the Payment

Accepting all the data is rounded out effectively, the individual you're sending the cash request to should then have the option to sign the back and either store it into their financial balance or money in the manner in which they would a standard check.

Assuming all the information is filled out correctly, the person you’re sending the money order to should then be able to sign the back and either deposit it into their bank account or cash it the way they would a regular check.

How to Fill Out a Money Order Correctly

Filling out a money order is as simple as plugging in the details mentioned above. The date and dollar amount should be automatically filled in for you when purchasing the money order; the rest you’ll need to add yourself.

Following these steps can help to ensure that your money order is properly completed before sending it off to the payee.

1. Fill In the Payee’s Name

The payee is the party that receives the money you’re sending via money order. This could be a person if you’re making a cash payment to an individual. Or it could be the name of a business if you’re using the money order to pay a bill.

The payee’s or recipient’s name should go in the field marked “Pay to the Order of” or “Pay to” on your money order. Write their name clearly and in ink so that it can’t be altered later if the money order is lost or stolen.

Filling the payee field out first is important because, until that’s filled in, anyone could write their name on the money order and cash it.

2. Add the Payee’s Address

Below the space for the payee’s name, you should see another field for the payee’s address. This is where you’ll add the recipient’s address information.

If the payee is a person, you may put their home address. If you’re using a money order to make a payment to a business, you’ll put the business address here.

Again, it’s important to write this information clearly and in ink. Double-check it to make sure you’re writing the street number and street name correctly.

3. Fill In the Fields for Purchaser Information

As the purchaser or person who buys the money order, there are a couple of fields where you’ll add your information.

First, you’ll fill in your name. This spot may be marked “From” or “Purchaser” on the money order, depending on where you purchase it.

Next, you’ll write down your address. This typically goes underneath your name, if this information is required.

4. Complete the Memo Line

Somewhere on your money order, you may see a “Memo” field. This is where you’ll write the purpose of the money order.

For example, say you’re using a money order to purchase a used car from a private seller. You could write a note in the memo line specifying that that’s what the money is being used for.

Or, if you’re paying a bill, you could mention that in the memo line. You’ll also want to include the account number for the bill you’re paying here.

5. Finish the Money Order by Signing It

Somewhere on the money order, you should see a “Signature” field. This is where you’ll want to add your signature once you’ve filled out the rest of the money order.

This final step before you can send it off to the recipient is not required for USPS postal money orders. (Indicator on the image above shows where such signature field may appear on other money orders.)

You may also see a space for a signature on the back of the money order, but that’s not for you. That’s where the payee signs the money order once they’ve received it.

What to Do After Filling Out a Money Order

After you’ve filled out all the necessary fields on the money order, read through it again to be sure all the information is correct. If you see that you’ve made a mistake, don’t try to correct it yourself.

Instead, show the error to the person or business you’re buying the money order from. Depending on their policy, they may be able to correct it for you. Or you might have to cancel the money order if you’ve already paid for it and purchase a new one.

If you haven’t paid for your money order yet, you’d need to do that first before you can send it. Typically, you need to have cash or a debit card to pay for money orders. But some money order issuers will allow you to pay with a credit card.

Aside from the face value of the money order, you’ll also have to pay whatever fees the issuer charges, which can range from under a dollar to $5, depending on where you purchase the money order.

Once you’ve paid, hold on to your receipt. This receipt should include a tracking number that you can use to track the money order and see when it’s cashed.

Your receipt will also come in handy if you later need to cancel or replace a money order because it’s lost or stolen. Without the original receipt, you may have a harder time getting your money back if a money order comes up missing.

Money Order Mistakes to Avoid

Filling out a money order shouldn’t be a complicated process if you know what information is needed and where it should go. But as you complete a money order, take care to avoid these common mistakes:

- Misspelling the payee or recipient’s name

- Writing the wrong payee or recipient address

- Leaving the recipient field blank

- Writing your name or address incorrectly

- Not including an account number in the memo line (if you’re using the money order to pay a bill)

- Forgetting to sign the money order

- Losing track of your receipt

Another mistake to avoid is not comparing money order purchase fees before you buy one. Although money orders typically only cost a few dollars, some issuers charge higher fees than others.

You should also review a money order issuer’s policies on canceling or replacing a lost or stolen money order. Ideally, losing a money order or having it stolen isn’t something you have to worry about. But if either scenario happens, it’s helpful to know beforehand what you’ll need to do to resolve the situation and get the money back.

Money Order Alternatives: Other Ways to Pay

A money order can be a safe and secure way to send money, but it’s not the only way to make payments to individuals or businesses.

For instance, you could always choose to pay cash. But, while paying cash may be an obvious choice, it’s not always a realistic one. And paying cash doesn’t create a paper trail the way paying with a money order does.

If you’re interested in payment methods other than money orders, and you have a bank account, you could make payments via:

- ACH transfer

- Wire transfer

- Personal check

- Cashier’s check

- Certified check

Each of these options provides a secure way to make payments. The biggest differences between them lie in the cost and speed.

An ACH transfer lets you transfer money from one bank account to another electronically. For example, if you need to pay your mortgage, you could use an ACH transfer from your bank.

ACH transfers are free, but they can take a few business days to process. A wire transfer, on the other hand, can be completed in just a few hours. The trade-off for that convenience, however, usually means paying a fee to your bank.

Cashier’s checks and certified checks are two forms of official checks you can secure at a bank using your bank account. A cashier’s check is drawn on the bank’s account, while a certified check is drawn directly from your account. But either one can be used in place of a regular personal check, though your bank may charge a small fee for issuing one.

Other payment options include using a person-to-person payment app or a prepaid debit card. Person-to-person payment apps let you pay bills and send money from your bank account without having to write checks. A prepaid debit card enables you to load money onto the card, which you can then use to pay bills. You might consider that option if you don’t have a traditional bank account.

Keep in mind that opening a bank account can be a helpful and convenient way to manage your money and make payments.

What is a money order and how does it work?

Key takeaways. A money order is a safe alternative to cash or a personal check; it works like a check so you can cash it or deposit it into a bank account. When using cash or personal checks puts you at risk, or they aren't accepted for payment, you can use a money order instead.

How do you get a money order?

You can purchase a money order with cash or with a debit or credit card. They're available for sale at banks, credit unions, the U.S. Post Office, and even Wal-Mart stores. Most money orders typically have a $1,000 limit, so you may need to purchase multiple money orders to make payments for bigger amounts.

Does money order mean cash?

Much like a check, a money order is a paper form of payment. ... That's because you purchase a money order with cash or another guaranteed form of payment, such as a traveler's check or a debit card. You can't purchase a money order with a personal check or a credit card.

What is a money order vs a cashier's check?

A cashier's check is a type of official check that banks issue and sign. Money orders are available in several places, including the U.S. Postal Service, convenience stores, drug stores, grocery stores, and check-cashing companies. It is generally easier to buy money orders, but cashier's checks are more secure,

Are money orders safe?

Are money orders safe? Money orders are generally a safe alternative to cash or checks since only the payee will be able to cash or deposit it for the amount printed on the document. As long as you keep your receipt, you'll be able to track your payment and recover any funds if it's lost, stolen, or damaged.

What are the charges for the money order?

Current Postal Rates in India

Type of MO Service | Particulars | Charges (in INR) |

Smart Money Order | for every Rs. 20 or part thereof | 1.00 |

IMO | For Rs. 1000-10000 | 100.00 |

For Rs. 10001-30000 | 110.00 | |

For Rs. 30001-50000 | 120.00 |

Do banks do money orders?

Cashier's checks and money orders can be purchased at banks and credit unions, but money orders can be bought at many other places, including various grocery stores and convenience stores, Western Union, the post office, and Walmart.

Where is the best place to get a money order?

9 Best Places to Purchase a Money Order in 2020

- Walmart. ...

- Publix. ...

- Kroger. ...

- CVS. ...

- Meijer. ...

- Your Local Bank. ...

- United States Postal Service. Your local post office will probably sell money orders. ...

- The Credit Union. Last, credit unions will usually sell money orders and their fees are among the lowest.

Can I cash a money order at Walmart?

Walmart will cash MoneyGram money orders. Check Cashing fees may apply. For purchases over $1,000 a valid government-issued photo ID is required. ... $1 max fee, but exact fees vary by location.

Can you get scammed with a money order?

A money order is essentially a paper check that's not connected with a bank account. ... Money orders can be a convenient way to receive or send money—but they're also susceptible to fraud. Money order scams usually target online sellers of merchandise or services, but buyers can fall victim as well.

How long do money orders take?

If you are delivering the money order in person and the recipient is redeeming it for cash, the entire process can realistically be completed in under an hour or two. Mailing a money order can take about a week, and if you need a replacement or refund for the money order, this can take up to 60 days

What banks allow you to get a cashier's check without an account?

If you don't have a checking account at a bank or credit union, you might need to open one. Banks and credit unions are the only institutions that can issue cashier's checks, and many don't provide them to non-customers. If opening a bank account isn't practical, a money order might be your next-best option.

Does a money order have your name on it?

On most money orders, it's your signature that's requested, just as you sign a check. But on USPS money orders, the blank is only labeled “From.” Whether you write or sign your name is up to you. ... USPS money orders offer additional space for the address of the recipient.

Can I open a bank account with a money order?

If you don't have an account at a bank or credit union, you can use this money order for your initial account opening deposit. ... Banks may require you to deliver the original money order to your bank for processing, and many don't allow mobile money order deposits at all.

How do you deposit or cash a money order?

To Cash-OUT a Money Order followed these steps:

- Bring your money order to a location that will cash it. You can take the money order to your bank, credit union, grocery store, and some retail stores. ...

- Endorse your money order. ...

- Verify your identity. ...

- Pay service fees. ...

- Receive your cash.

Can I Mobile deposit a money order?

The process for depositing a money order using a mobile app is the same as depositing a check. The general steps are: Sign the back of the money order and write your bank account number beneath your signature. Open the mobile app and take photos of the front and back of the money order.

1 Comments

Love your post :)

ReplyDelete